🏡 Why Trump’s 50-Year Mortgage Proposal Matters

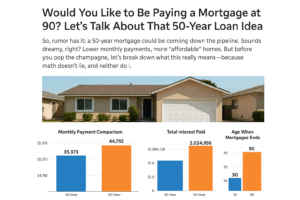

- Lower Monthly Payments: Extending a 30-year mortgage to 50 years spreads costs across 600 months instead of 360—substantially easing monthly payments. For example, a $400,000 loan at ~6.5% drops from ~$2,528/month (30-year) to ~$2,255/month (50-year), saving around $273 monthly. [adkins-ass…ciates.com], [factually.co]

- Higher Total Interest: Stretching payments into old age dramatically increases interest paid. In that scenario, total interest rises from ~$510,178 to ~$952,921—an extra ~$440,000. [adkins-ass…ciates.com], [factually.co]

The Age Factor: First-Time Buyers at 40

- Median homebuyer age is now 40—an all-time high. [realtor.com], [entrepreneur.com]

- With a 50-year loan, paying off a house would push the payoff age to 90, well beyond the average U.S. life expectancy of ~78.4 years. [aol.com], [thehill.com]

- Equity builds slowly: After 20 years, a 50-year mortgage typically pays off just ~11% of the principal—only ~46% is paid down in a 30-year one. [aol.com], [thehill.com]

A Southern California Case Study

- Median home prices (September 2025):

- Los Angeles County: ~$983,230

- Orange County: ~$1,401,250

- Riverside County: ~$624,000 [www.laalmanac.com]

Let’s model a typical LA county home of $1,000,000 with 20% down ($800,000 loan), using 6.5% interest:

| Loan Term | Monthly P&I Payment | Total Paid (Loan+Interest) |

|---|---|---|

| 30‑year | ~$5,048 | ~$1.817M |

| 50‑year | ~$4,493 | ~$2.696M |

| Savings | ~$555/month | +$879,000 extra paid |

— a staggering increase of over 48% in total interest costs.

Broader Impacts: More Than Just Payments

💰 Equity & Wealth Building

- Equity grows far slower under a 50‑year mortgage. After 30 years, you might owe ~$378,000—only ~62% equity—unlike owning your home outright. [investing.com], [realtor.com]

📈 Market Effects

- Access to long-term loans could boost demand—pushing prices higher if housing supply doesn’t keep up. [thehill.com], [realtor.com]

⚠️ Risks & Vulnerability

- Longer debt horizons mean increased susceptibility to economic downturns. Homeowners may remain underwater for decades and have little cash cushion. [thehill.com], [housingwire.com]

How Long Will It Truly Take to Pay Off?

With average age at first purchase of 40:

- 30‑year mortgage → paid off by ~70

- 50‑year mortgage → paid off by ~90 (after typical life expectancy). [thehill.com], [aol.com]

That leaves many never owning outright before retirement—or ever.

🚦 The Takeaway: Short-Term Relief, Long-Term Costs

Pros

- Makes monthly payments easier

- Helps younger buyers or those with tight budgets

- Could enable buyers to enter higher-cost markets

Cons

- Inevitably costs hundreds of thousands more in interest

- Equity accumulates slowly—wealth building stalls

- Prices might swell due to increased demand

- Extended debt exposure carries financial risk

Unless rates drop dramatically or refinance options are used, a 50‑year mortgage shifts the financial burden far into the future—potentially out of reach for many homeowners.

50-Year Mortgages Won’t Make Housing More Affordable

Treasury official pours cold water on 50-year-mortgage proposal

I’m licensed in Maryland and California. Areas I cover are Los Angeles county and Orange County in

California. In Maryland I cover Prince George, Ann Arundel, Charles, Howard, Montgomery counties.